What is the average commercial truck insurance cost?

If driving a truck is part of your commercial activity, then protecting your assets, cargo, and other people with adequate commercial truck insurance coverage is a necessity. But the average commercial truck insurance cost is capable of digging deep into your pockets. This is because the rate of road accidents is rising, and so is the price of premiums. The approximate cost of an accident involving a truck is estimated to be $148,279.

However, the increasing graph of accidents is not the singular factor which contributes to high insurance prices. From the rising rates of litigation and medical to inexperienced drivers entering the trucking industry, there are numerous elements that fuel the price of truck insurance.

Whether you are an individual trucker or owner-operators you should know how the cost of commercial trucking insurance is determined. In this post, we have covered every bit and piece of information on this very concept along with a few methods to lower your policy price. Let’s get going!

Average commercial truck insurance cost in different states

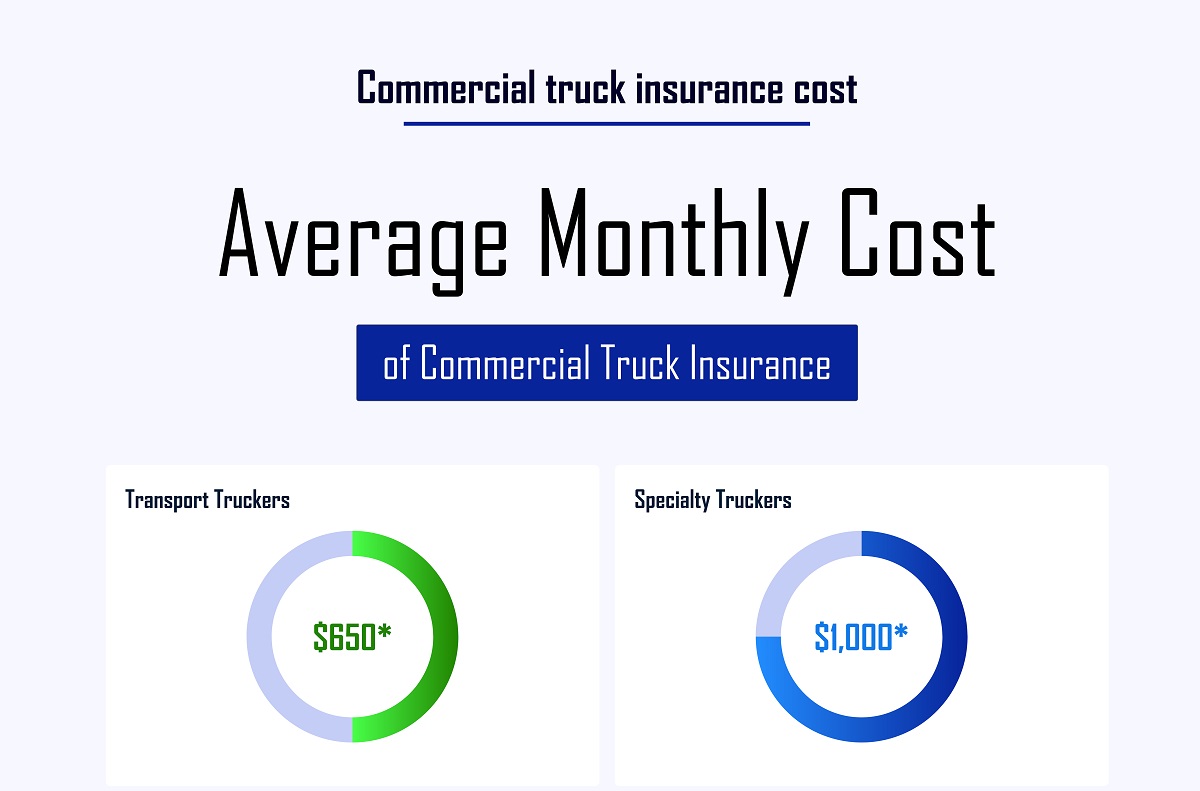

Speciality truckers transporting niche cargo like waste, hazardous material, or septic are likely to pay approx $650 per month. On the other hand, transport truckers who deal in hauling vehicles and other goods are required to carry approx $1000 insurance.

Trucks weighing over 26000 pounds needed to get extra coverage. The scale can go from approx $50000 to $300000; the actual price depends on which range your truck falls into.

In Florida, the minimum personal liability protection and property damage coverage are approx $10000.

In Georgia, truckers are required to have approximately $75000 liability coverage for general cargo. This cost might rise if you haul hazmat, oil, or household goods. Whereas in Ohio, the average cost of commercial auto insurance is estimated to be approx $15000, truckers are supposed to pay premiums between $12000 to $20000.

Click here to find your state and example commercial auto insurance rates

If you operate across interstate borders, you need to follow the transportation guidelines of the US. They require you to carry approx $75000 liability protection.

Find Average Commercial Truck Insurance Rates by State

Average Truck Insurance Cost by Type of Truck

Tractor Trailer (Semi-Trucks) Insurance Cost

Tractor trailer or semi-truck, insurance costs can vary significantly based on factors like coverage options, driving history, and the truck’s usage. On average, insuring a semi-truck can cost between $7,000 to $12,000 annually. This includes primary liability, physical damage, cargo insurance, and other necessary coverages.

Box Truck Insurance Cost

Box truck insurance typically ranges from $3,000 to $6,000 per year. The cost includes primary liability, physical damage, and cargo coverage. Factors such as the size and weight of the truck, driver experience, and route locations can influence the premiums.

Hot Shot Truck Insurance Cost

Hot shot trucking insurance costs are generally lower compared to other truck types, with annual premiums ranging from $5,000 to $7,000 for comprehensive coverage. This includes primary liability, cargo insurance, and physical damage coverage. The specific cost depends on factors such as the truck’s weight, cargo type, and driving radius.

Dump Truck Insurance Cost

Dump truck insurance can be quite expensive due to the higher risk associated with these vehicles. The average annual cost ranges from $6,000 to $10,000. This includes primary liability, physical damage, and additional coverages like motor truck cargo insurance.

Tow Truck Insurance Cost

Tow truck insurance is also on the higher end due to the risks involved in towing other vehicles. The average cost ranges from $7,000 to $15,000 annually. This comprehensive coverage includes on-hook towing insurance, physical damage, and general liability.

Your truck insurance cost will vary based on many factors. Be sure to read on or contact our team today for an accurate quote based on your needs and specific type of truck.

What factors contribute to average commercial truck insurance cost?

The cost of commercial truck insurance is rising at an ascending rate. As a trucker, you should know what is driving this phenomenon. Let us discuss each aspect.

Size of operations

Simply put, the bigger your trucking operation will be, the more trucks you will insure which would increase the price of truck insurance premiums.

Location of business

The price of truck insurance varies from state to state. For instance, if your operation comprises driving across borders, it increases the risk of exposure. A high level of risk exposure increases the rate of truck insurance and vice-versa.

Type of cargo hauled

Lightweight cargo comparatively experiences fewer damages than heavy ones in an accident. The greater the risk, the higher the insurance rate. Additionally, if your trucking operation involves transporting hazardous freight, you will require specific coverage like hazmat insurance.

Type and size of the vehicle

Insuring some vehicles is costlier than other types of trucks. If your truck model is older then expect to pay higher premiums for it. This is because older trucks often require more repair and maintenance than newer ones. Additionally, old trucks get damaged more severely in an accident than new ones.

Past accidental records

The driving records of truckers and the number of accidents they were involved in the past highly impact the average cost of truck insurance. If your trucker has been fined for rash driving or traffic violations, this will push the cost of the premium to the upper side.

Level of coverage and deductible

The more add-on you choose, the higher will be your premiums. You need to be very careful while selecting coverages for your trucks. Furthermore, choosing a lower deductible also adds up your insurance rate. So, you can pick a higher deductible and select only necessary coverages.

How can you lower the average cost of commercial truck insurance?

High truck insurance costs are impacting those drivers and businesses whose livelihood solely depends on trucking operations. The average cost of commercial truck insurance depends on the above factors, there are a few methods to lower your policy cost. By following the below-mentioned steps, you can give some sort of relief to your wallets.

Choose your trucks cautiously

As discussed already, the type of truck you own determines the amount of premium you will pay. Therefore, before purchasing, leasing, or renting a truck, it is a good idea to glance at the rate of insurance of the truck. Simply put, trucks with high risk attract expensive premiums.

Do staffing correctly

Drivers with high experience handle the truck well even in extreme weather conditions or other challenging situations. This is less risky, so when there is less danger, the price of insurance will be on the lower side.

Drive new trucks

Older trucks need more repair and maintenance than newer ones. They also experience frequent breakdowns which are risky on the road and also from the insurer’s point of view. To lower your insurance premium, stick to new trucks, for ten years or even less. However, routine upkeep of newer trucks might also affect the premium of your insurance.

Avoid the risk and drive safe

Your drivers can avoid those routes which are more congested or busier. They can also operate the truck during a non-peak period like later in the night. This will avoid likely accidents, collisions, or other risks. This will help them drive safely and maintain clean driving records, resulting in lower insurance prices.

Watch your add-ons

Some coverages are state mandated and a few are essential for your trucking business. However, avoid taking unnecessary add-ons, it will only elevate the cost of your premium. Stick to those coverages that are necessary.

Considering all the aforementioned factors will help you lower your truck insurance premiums. Moreover, you should be aware that the cost of carrying an inadequate policy can make you pay higher in the end. Insufficient coverage will not compensate you for all the damages you experience in an accident. So, always consider having a decent level of coverage that protects you against all likely risks that you are exposed to.

FAQs related to average commercial truck insurance cost.

The cost of insuring a truck is higher because it causes great damage in an accident. Plus, repairing or replacing a truck is much more expensive than any other vehicle.

Among the 50 states, Mississippi is the one whose truckers pay the lowest truck insurance premiums with an estimated cost of $355. The owner-operators of this state pay $325 for general liability insurance and $750 for non-trucking liability coverage.

The price of each insurance coverage varies because each offers a different level and type of protection

General liability will cost a company $500-$2000 depending on the number and size of the truck. For reefer breakdown coverage, drivers are estimated to pay $800 to $2000 per truck.

Motor truck cargo will cost truckers between $1000 to $2000. This cost can go up if the cargo is expensive. Trailer interchange costs $600 to $1000 (per trailer). However, speciality trailers with expensive replacement costs will increase the price of premium as well.

There are several factors which is analyzed while calculating the exact cost of commercial truck insurance such as:

Type and value of the truck.

Type of cargo you transport.

Location of your operation.

Driving history.

The radius of trucking operations, etc.

Primary liability for semi-trucks will cost you between $5000 to$7000. Whereas physical damage ranges from $1000 to $3000. For general liability, drivers will have to pay $500 to $500 and $1600 to $2200 for on-the-job accident protection.